Power semiconductors battleground

Even though wide bandgap semiconductors such as silicon carbide (SiC) and to a lesser extent gallium nitride (GaN) are making their presence felt in EV power conversion systems still dominated by silicon (Si), there is more performance to come from Si – and EVs are positioned to take advantage of competition among all three materials (writes Peter Donaldson).

Morahari Reddy, automotive expert at TechInsights, notes that EVs sit in the middle of the graph when you plot power output against switching frequency for the main applications of power electronics. National power distribution in the gigawatt and hundreds of Hertz ranges occupy the high-power, low-frequency end of the market, with consumer electronics, switch mode power supplies and cellular comms at the low power and mid-to-high frequency end.

Automotive applications overlap most closely with uninterruptible power supplies and inductive heating. This is also the area in which the optimal power and frequency outputs of IGBTs and MOSFETs as well as Si, SiC and GaN cross over, he says.

“There is considerable overlap between the technologies, particularly in the mid-power, mid-frequency range where discrete FETs from 600 to 1200 V and frequencies up to roughly 100 kHz lie, with all three materials staking a claim to this area,” says Reddy. Where power and frequency requirements rise together, SiC and GaN are likely to have the most impact.

The performance of individual power devices is defined by their position in the ‘power triangle’, which Reddy describes as the constant tug of war between resistance, switching speed and safe operating area (SOA). Resistance must be as low as possible when the device is on, it must switch as quickly as possible and operate safely and reliably.

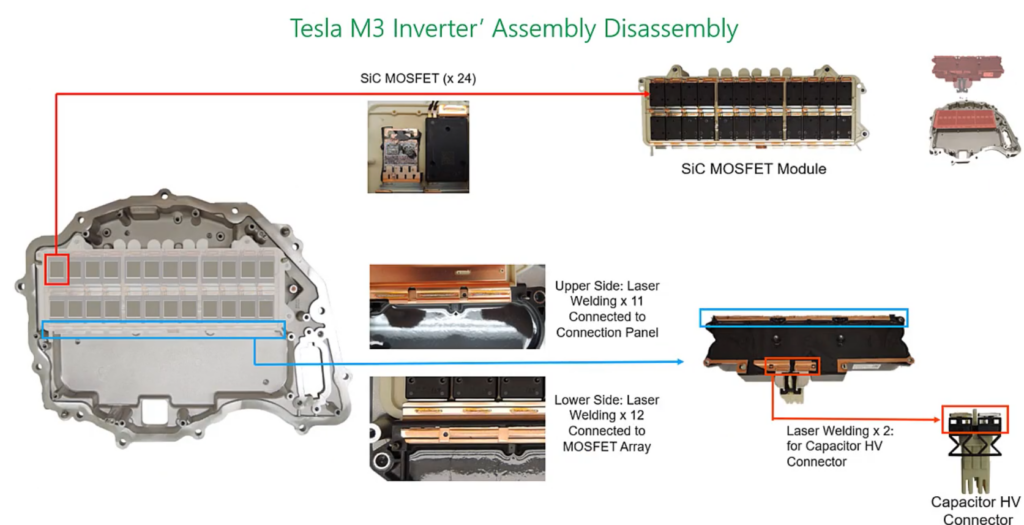

(Image courtesy of Munro & Associates)

“Trade-offs have to be made between them in device design,” Reddy says. For example, increasing the on-state performance may bring higher current density and more heat, compromising the SOA.

Innovation in silicon is not over though, he adds, citing the evolution of Infineon’s IGBT technology from the original planar designs with no wafer thinning through Fieldstop and Trench technology at the turn of the millennium to today’s Trenchstop 7, which contains sub-micron features.

However, lessons learned in silicon are being applied to the new materials, Reddy notes. “As SiC matures and finds its way into the automotive market, we are seeing many well-established routes to device improvement first perfected in silicon now being implemented in SiC – that is, incorporation of trenches and wafer thinning.”

He also suggests that techniques such as the use of dummy trenches to tune the capacitance in IGBTs might be applied to SiC, as might super-junction structures, despite some difficulties. “These two involve trade-offs and can have adverse effects on capacitance and switching, as well as the challenges involved in deep P-type column implementation in SiC,” he says.

Ian Riches, automotive lead at Strategy Analytics, expects SiC to become the dominant technology, with GaN emerging as well as it moves away from being considered primarily as a 48 V mild-hybrid technology and is developed for high-voltage applications, with onboard charging being the initial target application.

Reddy and Riches were presenters at a recent joint EV Technology webinar from TechInsights, Strategy Analytics and Munro & Associates.

ONLINE PARTNERS