Magnetic materials

Rare earth madness

Global politics is driving design decisions for magnets in motors, as Nick Flaherty explains

Rare earth materials, also known as rare earth elements (REEs), have become much more well known in recent months because their critical role in the e-mobility industry has become high-profile.

These 17 metallic elements (the 15 lanthanides, together with yttrium and scandium) all have similar chemical properties that boost the magnetic properties of metal alloys. Despite their name, these elements are not inherently rare, but they are often found in low concentrations and dispersed distributions, making large, concentrated deposits difficult to locate and extract.

Adding these rare earths into iron alloys and magnetising them creates magnets that are used for more efficient electric motors in electric vehicles (EVs) of all kinds, as well as the motors used for electric aircraft. However, China has come to dominate the supply of REEs and the resulting magnets.

“China accounted for 69% of the world’s production of rare earth elements in 2023, far ahead of the United States at 12%, Myanmar at 11% and Australia at 5%,” said Mathieu Xémard, project leader at the Centre Interdisciplinaire d’Études pour la Défense et la Sécurité (IP Paris).

“Once these ores have been extracted, they need to be processed to separate, purify and refine each of the rare earths. However, China is the only country that carries out all these stages, with Australia and the United States selling some of their semi-processed ores back to China to complete the refining. Thus, China produces 85% of the purified light rare earths used worldwide, and 100% of the heavy rare earths. In 2019, China accounted for 92% of the world’s production of rare earth permanent magnets

The materials are broken up into light REEs, comprising those from lanthanum to samarium and including neodymium, which are more suited to permanent magnets, and heavy REEs comprising those from europium to lutetium, including the costly dysprosium and terbium.

Up to one third of a magnet in an EV motor can comprise REEs, and restricting access to these materials has become increasingly politicised. Therefore, companies are looking at ways of producing highly efficient motors without using magnets formed of these materials, relying instead on inductive techniques rather than permanent magnets. This raises other issues, such as the availability of copper, leading to the development of motors using aluminium.

“In terms of rare earths that people get worried about, it’s about motors in cars rather than other forms of magnets. However, there are more general supply chain issues around copper and that’s probably a bigger issue,” said Dunstan Power, director at UK design consultancy ByteSnap that spun out the Versinetic EV charger business.

“Rare earths aren’t rare; it’s a misnomer. They are common around the world and often a byproduct of other forms of mining. The problem is that extracting them is difficult because they are in low concentrations. Its analogous to semiconductors; it’s more a tale of investment decisions and global politics than the rocks themselves. Over many decades, the West has outsourced many parts of manufacturing to the Far East in an intermeshed global supply chain.

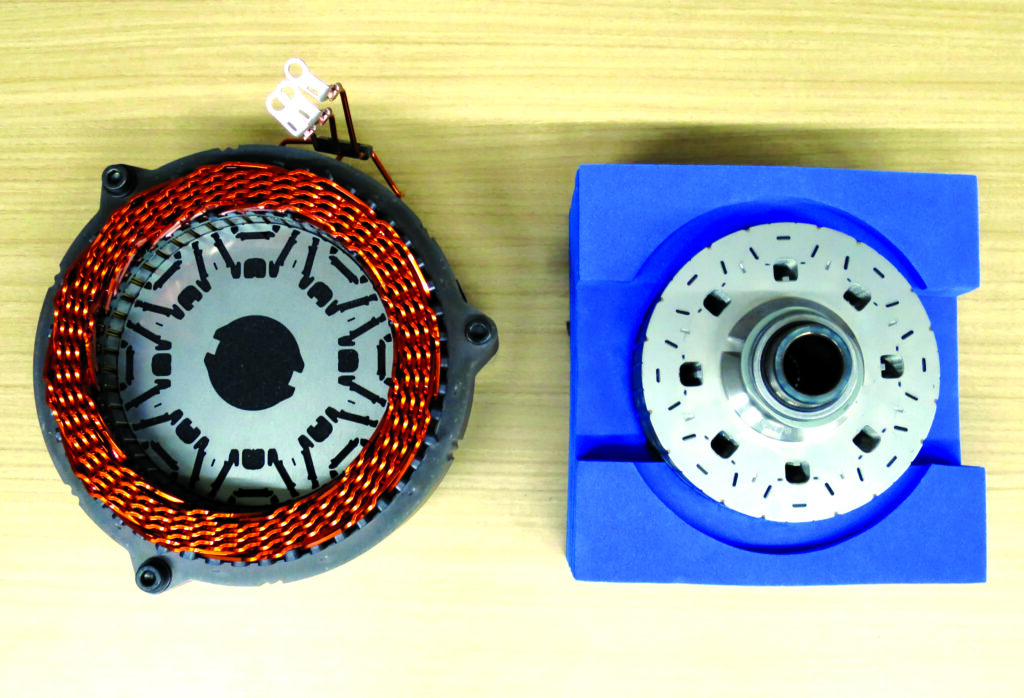

(Image courtesy of Toyota)

“When you have a centre of excellence, you build up expertise and infrastructure, and it’s around people,” Power said. “The Chinese make powerful magnets using combinations of rare earths and they have the expertise in this. Australia has large mineral deposits and it ships those to China to turn them into the magnets that go into e-motors. The challenge is reskilling to take them on and learn how to make the magnets.”

Xémard at IP Paris said: “The country has progressively moved from extraction to separation, via refining and metallurgy, to the manufacture of magnets. In the 1990s, Japan and the United States were the main magnet manufacturers.

“Their know-how was based on strong expertise in metallurgy and precise control of the composition of the magnetic alloys they produced. But in the United States, Magnequench – the General Motors subsidiary responsible for magnet production – was bought out by two Chinese groups in 1997. In Japan, China first established itself as a supplier of purified rare earths, then pushed Japanese companies to relocate part of their magnet production to gain access to Chinese markets, thereby gaining access to the last missing technologies in the early 2010s.”

None of this is a surprise, but it has taken time for countries to recognise the risks to the supply chain, and to support the development of magnetic materials without REEs and with alternative sources.

Developing recycling processes has also taken time, but several schemes are now scaling up in the UK and North America.

“Permanent magnet motors use current more efficiently than AC induction motors with fewer – but not zero – losses in heat, stray eddy currents and core losses,” said Kevin Kurtz, VP of engineering at magnet maker SM Magnetics. “They also have their full torque available instantaneously, can be built much smaller in size, don’t require any maintenance, and have lowered in expense as the design efficiency has increased and alternative magnet chemistries and processes have been introduced. For example, we use less dysprosium – a very expensive element – in modern high coercivity sintered NdFeB magnets than we did 10 years ago,” he said.

“There is a great deal of rare earth material in the rotor assembly of these motors. But year after year, we’ve been able to cut down on these materials – especially the heavy rare earth materials with the greatest expense and rarity – while retaining the same or similar motor characteristics,” he added.

“By more efficiently designing the permanent magnets in the rotor assembly, experimenting with soft magnetic materials, lowering the clearance between the rotor and stator, and designing more sophisticated controllers for speed or more poles in the motor, as well as advancements in balancing and manufacturing – advanced automation, high yield, and very small tolerances – the power efficiency of these PM [permanent magnet] motors continues to increase as the expense decreases, making them the clear choice in modern electric vehicle propulsion.”

In hybrid vehicles, rare earth magnets play a vital role in the transmission systems, allowing for seamless switching between electric and internal combustion power.

Researchers are exploring the use of other materials, particularly cerium, which is the most abundant REE. This is already part of the automotive supply chain as a catalyst used in catalytic converters in automotive exhaust systems to reduce emissions.

Back in 2018, Toyota showed a magnet that cuts in half the amount of neodymium used by replacing it with cerium and lanthanum. This also does not need the incorporation of terbium or dysprosium, which are also often added to boost performance. This magnet is being developed internally for production motors.

Substituting neodymium with lanthanum and cerium, which are abundant and low-cost REEs allows high heat resistance to be maintained and loss of coercivity to be minimised. The neodymium-reduced, heat-resistant magnet is able to maintain coercivity, even at high temperatures, by refinement of the crystal grains in the magnet with a two-layered, high-performance grain surface.

The high coercivity at high temperatures is retained through reduction of the size of the magnet grains to one-tenth or less than the size of those found in conventional neodymium magnets and enlargement of the grain boundary area.

In a conventional neodymium magnet, neodymium is spread evenly within the grains of the magnet and, in many cases, the amount of neodymium used is more than is required to maintain coercivity. Reducing the size of the magnet grains increases the neodymium concentration on the surface, which is necessary to increase coercivity and boost performance, but reduces the concentration in the grain core, resulting in reduction of the overall amount of neodymium required.

(Image courtesy of KIMS)

If neodymium is simply alloyed with lanthanum and cerium, its performance properties (heat resistance and coercivity) decline substantially, complicating the use of light REEs. However, researchers at Toyota discovered a specific ratio at which lanthanum and cerium can be alloyed such that the deterioration of performance properties is suppressed.

“An increase in electric car production will raise the need for motors, which will result in higher demand for neodymium down the line,” said Akira Kato, general project manager at Toyota’s advanced r&d and engineering company.

“If we continue to use neodymium at this pace, we’ll eventually experience a supply shortage. So, we wanted to come up with technology that would help conserve neodymium stocks.”

REEs are used to create the grain boundaries that allow the magnetic performance of alloys.

The grain boundary diffusion process is a key technology designed to enhance the performance of permanent magnets. In this process, the heavy REEs are coated on the surface of the magnet, followed by high-temperature heat treatment. During the heat-treatment, the heavy REEs diffuse into the magnet’s interior along the grain boundaries, improving the coercivity – the ability of the magnet to retain its magnetisation.

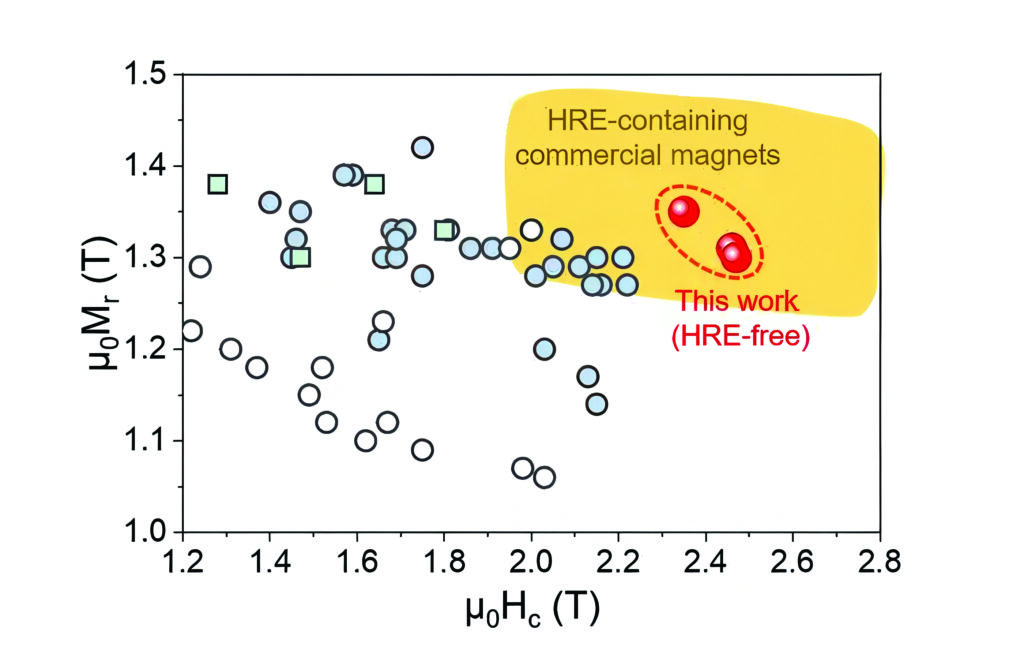

Researchers in Korea have developed a grain boundary diffusion process that enables the fabrication of high-performance permanent magnets without the use of expensive heavy REEs.

The Nano Materials Research Division at the Korea Institute of Materials Science (KIMS), led by Dr. Tae-Hoon Kim and Dr. Jung-Goo Lee, developed a two-step grain boundary diffusion process.

This starts with thermally infiltrating a new high-melting-point metal-containing material into the magnet at high temperatures, followed by room-temperature cooling.

The second step sees a low-cost light REE, praseodymium, re-infiltrated into the magnets at high temperature. This helps suppress abnormal grain coarsening that degrades the diffusion efficiency and magnetic performance.

The research team successfully controlled this issue, which had been a major limiting factor in conventional diffusion processes, enhancing diffusion efficiency. As a result, the diffusion material is rapidly infiltrated into the magnet, significantly improving coercivity. This enables the magnet to achieve performance grades of 45SH to 40UH, equivalent to commercial magnets that contain heavy REEs, despite using only light REEs.

If this technology were commercialised, it could reduce manufacturing costs while enhancing performance in high-value products that require high-efficiency motors such as EVs and eVTOL air taxis.

“Currently, the use of expensive heavy rare earth elements in magnets for electric vehicle motors and high-end home appliances is inevitable. However, owing to the concentration of heavy rare earth resources in specific regions and their high costs, researchers worldwide have been striving for years to develop technologies that can reduce or replace heavy rare earths in magnets – yet progress has remained stagnant,” said Dr. Tae-Hoon Kim, principal investigator of the study.

“This technology demonstrates the potential to break free from heavy rare earth dependency in high-performance magnet manufacturing. Moreover, it presents a new direction for research on grain boundary diffusion processes, a core technique in the permanent magnet industry.”

Other magnetic materials

“There’s been a lot of attention focused on a new type of permanent magnet material, iron nitride [FeN],” said Vandana Rallabandi, a member of the research and development staff at Oak Ridge National Laboratory (USA).

This magnet, produced by Niron Magnetics, has high remanence, equivalent to that of REE magnets, but has coercivity of just 20% of that a comparable neodymium-iron-boron (NdFeB) magnet.

Because of these fundamentally different properties, FeN magnets require the development of new rotor designs, which will probably resemble those of past alnico motors. Niron is now developing such designs with automotive partners, including General Motors.

Last year, researchers at Oak Ridge National Laboratory developed a 100 kW traction motor that uses no heavy REEs in its magnets.

“We faced several fundamental challenges in keeping the magnets from getting too hot because permanent magnets are good conductors,” said Rallabandi. “When an electrical conductor moves in a magnetic field, which is what rotor magnets do while the motor is operating, currents are induced in it. These currents, which do not contribute to the torque, heat up the magnets and can demagnetise them. One way to reduce this heating is to break up the path of the circulating currents by making the magnets from thin segments that are electrically insulated from one another; in our motor, each of these segments was only 1 mm thick.”

“We chose to use a grade of NdFeB magnet called N50 that can operate at temperatures up to 80 C. Also, we needed to use a carbon-fibre-and-epoxy system to reinforce the outer diameter of the rotor to let it spin at speeds as high as 20,000 rpm. After analysing our motor prototype, we discovered it would be necessary to force air through the motor to reduce its temperature when operating at maximum speed. While that’s not ideal, it’s a reasonable compromise to avoid having to use heavy REEs in the design.”

Other materials such as high-silicon steel are promising candidates for rotor construction, offering the potential to improve the magnetic efficiency of REE-free motors. Doubling the conductivity of copper, for example, could reduce the volume of certain motors by 30%. The strategic integration of such materials could dramatically narrow the performance gap between REE-containing and REE-free motors.

Mining materials

The University of Texas at Arlington has been awarded a $1.3m grant to develop a more efficient process for sourcing the REEs needed to produce high-performance magnets. Led by Prof. Ping Liu, the project aims to make the mining of these critical materials more cost-efficient and environmentally sustainable by using cheaper, more abundant materials.

Liu is working with researchers from Ames National Laboratory in Iowa and MP Materials, a Fort Worth-based magnet manufacturer. The team plans to source REEs from the Mountain Pass mine in Nevada, the largest REE mine in the Western Hemisphere. These materials will be processed at MP Materials’ Fort Worth facility to produce high-quality magnets for technology manufacturing.

“Upon successful completion of the project, we plan to have a working pilot project that can be scaled for manufacturing and mass production,” said Liu. “Our new designs will create valuable, environmentally friendly manufacturing jobs while helping reduce our reliance on international suppliers for materials critical to high-tech devices.”

(Image courtesy of HyProMag)

Recycling

“At Ecole Polytechnique [IP Paris], we are working on the development of products that use recycled materials without necessarily involving the high levels of purity needed to manufacture magnets,” said Xémard. “For example, we are studying the influence of substitutions or impurities on the magnetic properties of rare earth alloys. It is also possible to find higher value-added outlets for rare earths whose markets are shrinking [cerium and lanthanum in particular], which would make it possible to increase the added value of rare earth separation activities. The use of artificial intelligence is also envisaged as an accelerator for this type of application.

Ionic Technologies in Belfast (UK) has developed REE separation and refining technology applying this technique to the recycling and refining of individual magnet rare earths from spent permanent magnets. The process is agnostic on feedstock magnet quality and variability in feed composition. It is working with the r&d group of car maker Ford and Less Common Metals (LCM) on a circular supply chain for the materials, recovering REEs from motors used in Ford EVs.

The company, which began as a spin-out of Queens University called Seren Technologies, takes spent permanent magnets that then are crushed and ground into a fine powder. This powder is then treated with a strong acid solution to dissolve the REEs.

The dissolved REEs undergo a series of precipitation and purification steps to isolate a mixed rare earth oxide (REO) product. This mixed REO is then separated into individual REEs, such as dysprosium and terbium, through a specialised separation circuit.

The separated elements are converted to oxalates and then calcined to produce high-purity REOs.

The company is now part of mining firm Ionic Rare Earths, which mines neodymium, dysprosium, praseodymium and terbium in the Makuutu Rare Earths project in Uganda, which is also one of the largest scandium resources in the world.

Meanwhile, HyProMag in the UK, which is also part of the Mkango mining group, has been building a plant to recycle scrap magnets.

As part of the just-completed SCREAM project with GKN Automotive, European Metal Recycling, Jaguar Land Rover, Bowers and Wilkins and the University of Birmingham, it has developed two paths to introduce scrap material back into the rare earth supply chain. The first scales up a process developed at the University of Birmingham using hydrogen processing. The second produces a mixed rare earth carbonate for the rare earth supply chain.

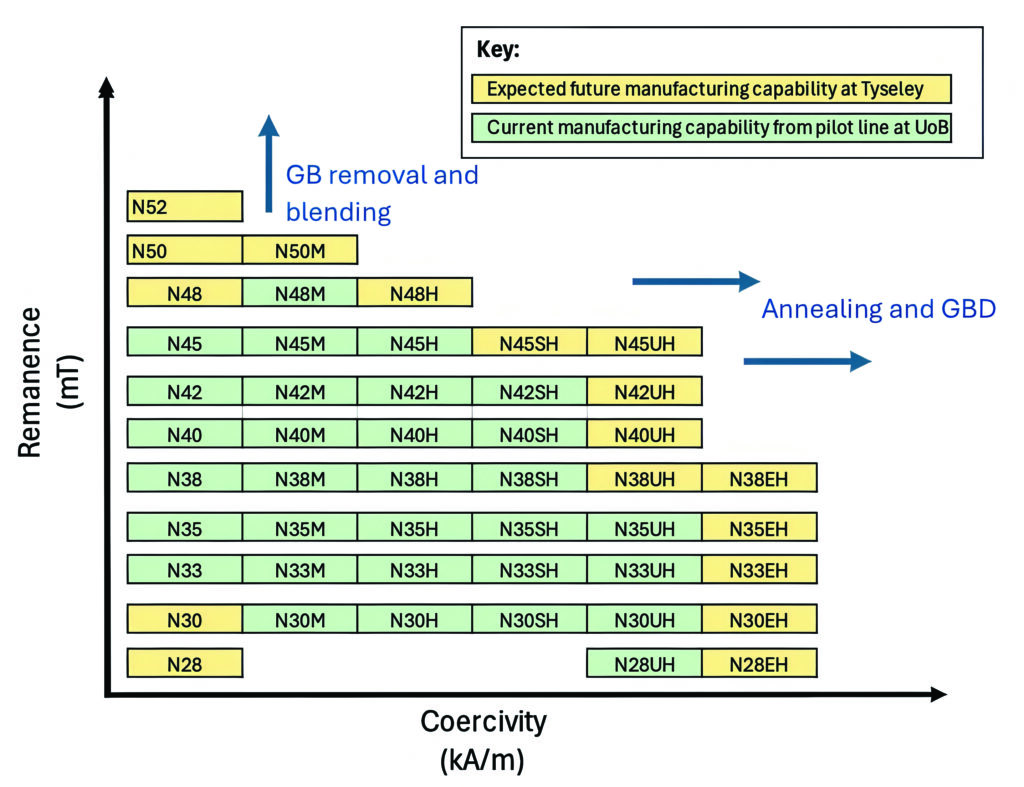

The pilot line at the University of Birmingham has produced over 3500 magnets of commercial grade from various waste streams. Sample magnets have been provided to commercial partners, including automotive supplier ZF, for extensive testing and product verification.

The hydrogen process has been further optimised for different NdFeB scrap sources, particularly the removal and recycling of magnets from e-motor rotors, where they are embedded in laminated stacks of transformer steel.

Increased magnetic performance has been achieved through further optimisation of the magnet manufacturing processes, with positive feedback from customers who are currently stress-testing magnet prototypes.

In its technical update in June 2025, the company highlights that the manufacture of sintered, commercial-grade magnets need not be confined to producing magnets directly from scrap, and could be further enhanced by blending with new cast alloys made from virgin mine-sourced metals or recycled metals. It is researching the use of blended recycled powders with virgin materials, which will broaden the range to higher magnet grades available commercially.

Over 100 different blends of recycled material have been created in the last six months to meet r&d and customer requirements, with magnets derived from both single and blended batches of powder.

HyProMag has also used the recycled powder to develop magnets of different grades for a range of applications, with Bowers and Wilkins, GKN Automotive and Jaguar Land Rover assessing the suitability of the magnets for a range of products including motors, loudspeakers and holding magnet applications containing recycled magnets.

It is also part of the REEsilience project, funded by Horizon Europe in the EU, which is coordinated by the Institute for Precious Metals and Technology of Pforzheim University (Germany), and brings together 16 project partners and two associated partners from 10 European countries.

Design issues

Tier One component supplier ZF predicts that recycling of REEs is about to take off in a big way. Initiatives that promote this special recycling are therefore in demand worldwide. The Sustainable Recovery, Reprocessing and Reuse of Rare Earth Magnets in a European Circular Economy project aims to boost recycling of magnets to 25% by 2027, bringing together 19 companies from different industries.

ZF is looking at how motors can be developed to enable efficient disassembly at the end of product life.

“Optimising designs to make best use of critical rare earth materials, using magnet-free designs where appropriate, and ensuring rare earth metals where used aren’t lost at the end of a product’s life all contribute to a truly sustainable future,” said Dr. David Moule, electric drives technical specialist from the ZF Servo Drives Centre of Competence.

Other projects in the UK include Lightning Machines and The University of Warwick looking at the recovery of REEs from electric vehicles, while Magnetic Systems Technology and Hirst Magnetic Instruments are also looking at the recovery and reuse of magnets.

At the same time, Seloxium and the University of Oxford are looking at ways to produce REEs from volcanic ash, while Altilium Metals and the University of Exeter are investigating how to recover REEs from mining tailings – the leftover materials from the mining process that consist of finely ground rock, water and, often, chemical reagents used to extract the minerals.

Meanwhile, Cyclic Materials in Canada is developing North America’s first Centre of Excellence for REE recycling in Kingston, Ontario.

Cyclic Materials, founded in 2021, launched a commercial demonstration facility using its MagCycle process to recover rare earth magnets in 2023. Last year, it opened a second facility in Kingston, Ontario, producing mixed REOs via its REEPure hydrometallurgical process.

The proprietary MagCycle disassembly techniques and REEPure processing technologies recover REEs from end-of-life products such as EVs, wind turbines and data centre hard drives.

The $25m centre will combine full-scale commercial processing and r&d based around the company’s REEPure technology. The facility is designed to convert 500 tonnes of magnet-rich feedstock annually into a recycled mixed REO with neodymium, praseodymium, terbium and dysprosium. The feedstock comes from Cyclic’s Arizona-based ‘Spoke,’ where end-of-life products will be processed, as well as a growing network of partners supplying magnet scrap from production.

Operations are set to begin in the first quarter of 2026 to supply key partners within the magnet value chain, such as Solvay in France, providing a secondary resource of critical REEs.

The site will also house a state-of-the-art r&d centre, including advanced labs and a mini-Spoke line, to accelerate process optimisation and scale next-generation technologies across the rare earth value chain.

Today, less than 1% of REEs are recycled, and global supply chains remain highly sensitive to growing geopolitical tensions and supply concentration.

REE-free designs

At the same time, there is a strong push to develop magnetic materials without the need for REEs. Machine learning is being used to find materials that can replace both light and heavy REEs in magnets, and 16 projects within the Circular Critical Materials Supply Chains programme in the UK are underway to look into this.

In one of those projects, LCM is working with Materials Nexus to reduce the use of heavy REEs in high-performance permanent magnets without affecting performance.

Ricardo in the UK has developed a motor that eliminates the need for REEs and critical raw materials, such as cobalt. It uses aluminium hairpin windings, and the machine is oil-cooled to generate a power output of 214 kW and maximum efficiency of greater than 92%, making it suitable for light commercial vehicles and off-highway applications.

The need to move to magnets with less reliance on REEs and motors with no REEs at all was recognised several years ago, together with the requirement for sourcing and processing in the West in combination with recycling. These materials, which are now emerging as commercial options, will still require some time to be adopted in vehicle designs, while the recycling aspect relies on vehicles reaching their end of life in the coming decades.

Click here to read the latest issue of E-Mobility Engineering.

ONLINE PARTNERS