EV battery supply chain problems not all doom and gloom

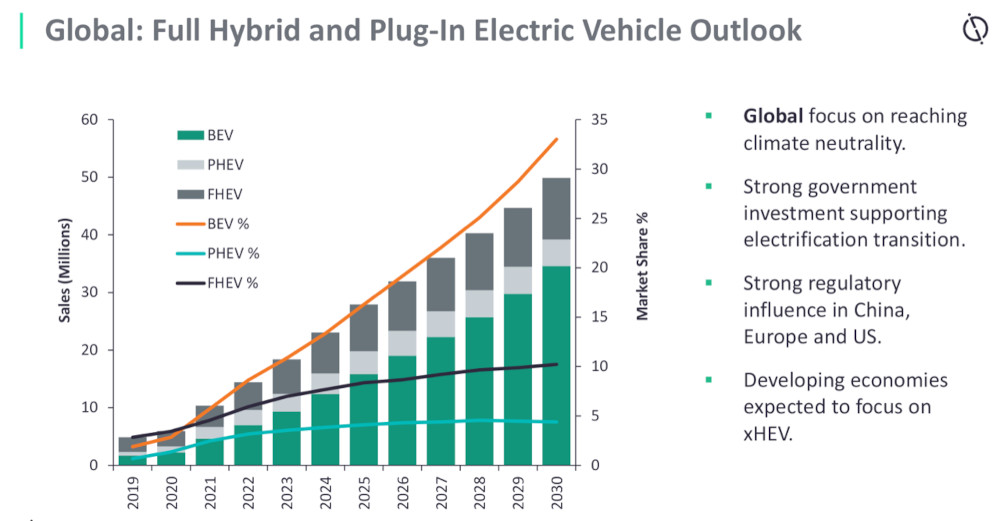

(Source: LMC Automotive Global Hybrid & Hybrid Forecast)

Although global demand for new EVs is strong, the whole industry is still being disrupted by factors including the effect of the Covid-19 pandemic on supply chains, sanctions in response to the war in Ukraine, and inflation (writes Peter Donaldson). At September’s Battery Show in Novi, Michigan, LMC Automotive’s senior manager, powertrain forecasting, Kevin Riddell, outlined the factors affecting the development of batteries for light vehicle electrification.

“The automakers have tried to prioritise and protect their battery EV [BEV] agenda as much as possible, but disruptions continue to be seen, particularly as the supply chain for batteries is still being developed,” he said.

“With so many new products entering production, even over the past year, the price of lithium has gone through the roof. The restrictions on nickel supplies due to sanctions against Russia is adding to this challenge.”

He further stressed that these supply limitations are directly impacting the affordability of BEVs.

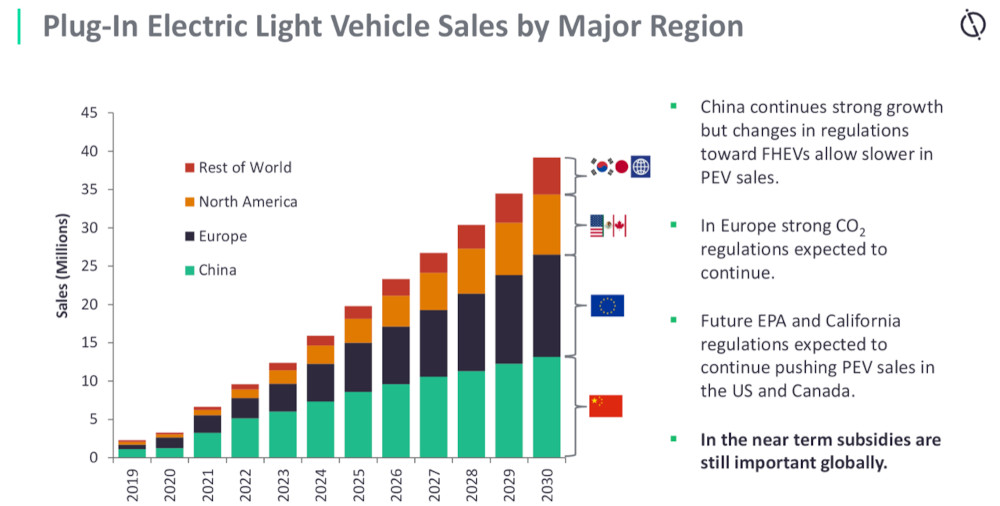

Despite that, he said demand for BEVs from January through July this year grew by 30% in Europe and 66% in the US, but in China it was 112% – a lead he ascribes to several factors.

“One of the biggest differences is infrastructure,” he said. “I have heard estimates of the number of public charging points in China ranging from 800,000 to 1.15 million. Europe and the US are both far behind in that measure.

(Source: LMC Automotive Global Hybrid & Hybrid Forecast)

“Regulations are also stronger, with 50% of new vehicles expected to be new energy types by 2030, directly imposing a national zero-emissions fleet target.

“There is also considerable diversity in price point, particularly in China. The most popular BEV there, the Wuling Hongguang Mini, starts at about $5000 equivalent.”

In developing economies, Riddell said he expects the focus to be on hybrids of all types, as most countries in the world have signed up to the Paris Agreement on CO2 reduction but the charging infrastructure for BEVs is far less developed in these regions.

Despite the supply chain problems, he expects cell manufacturing capacity to exceed demand from EVs of all types in China and Europe, but not in the US and the rest of the world. He puts that down to stronger pro-EV regulation, and more BEV production and investment in battery production in China and Europe than elsewhere.

“Many OEMs are investing in new battery plants, either on their own or with a battery supplier. There are start-up companies who are also developing batteries though, and in anticipation of attracting interest from the automakers they will install capacity, awaiting future contracts,” he said.

ONLINE PARTNERS