ELM last-minute delivery truck

(All images courtesy of ELM)

The last mile

Peter Donaldson goes the extra mile to investigate the latest developments in urban deliveries

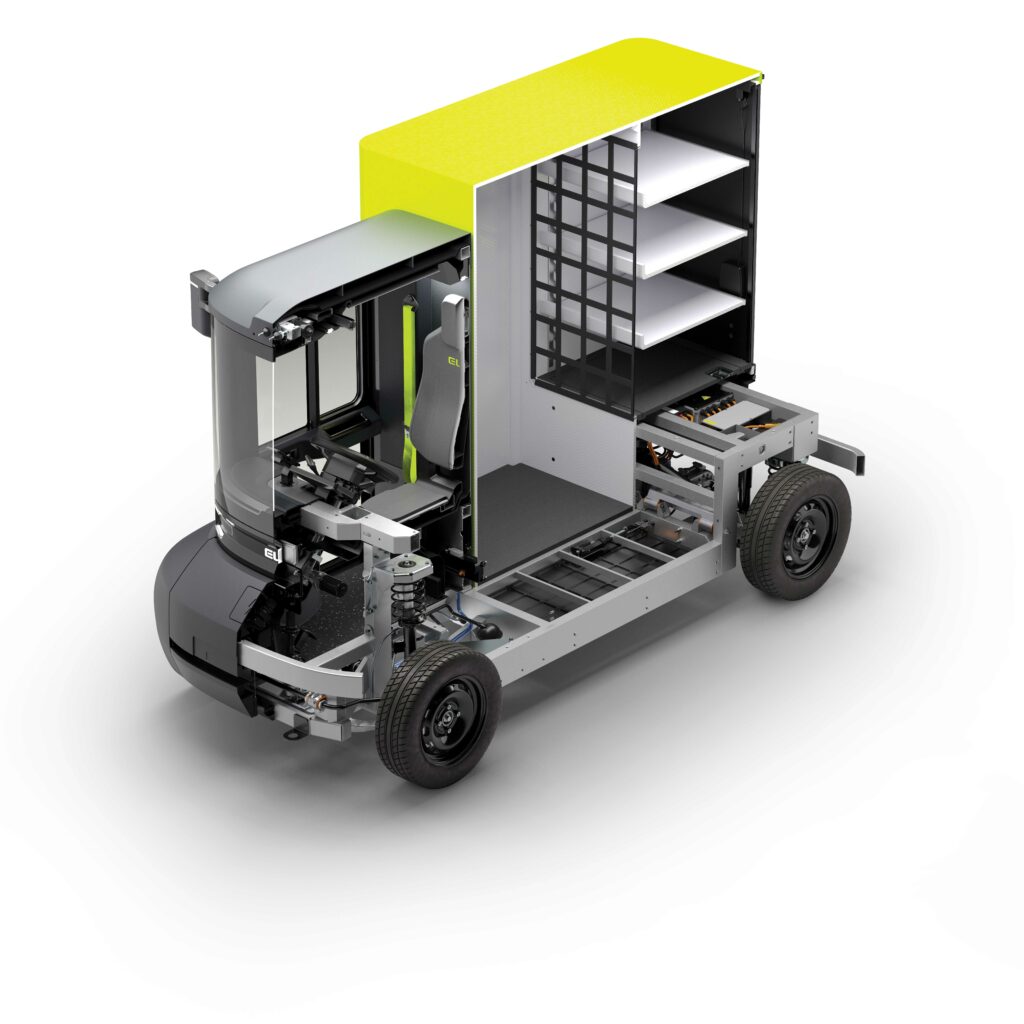

ELM Mobility has set itself the ambitious task of redefining last-mile delivery. The vehicle for this redefinition takes the form of a small battery electric truck in the L7e category. Efficiency, low cost and minimal downtime achieved through its robustness, simplicity and ease of maintenance and repair are key design drivers of the project. “Our mission is to lower the cost per delivery and reduce urban environmental impact,” says Carsten Astheimer, the company’s founder and co-CEO. He is also founder and MD of Astheimer Design, which is collaborating with Prodrive on the vehicle’s development. Along with Kevin O’Flynn, chief engineer, E/E systems at Prodrive, Astheimer briefed us on the project.

The two companies have a long history of developing commercial vehicles together, Astheimer points out, through which they have gained unique insights into the commercial vehicle market and the needs of logistics companies, which are most acute in urban last-mile delivery, Astheimer notes.

Early days

ELM Mobility agreed to talk in considerable depth about the programme at a relatively early stage in its development, having just finished the proof-of-concept phase and built a demonstrator based on a donor EV. While the resulting vehicle is visually, architecturally and ergonomically close to what is intended for the production machine, there are still many decisions to be made and much engineering to be done on the electric powertrain and other systems, more of which later.

Together, Astheimer and Prodrive founded ELM Mobility, now an independent entity, and provide it with services including customer requirements analysis, vehicle architecture, interior and exterior design, advanced drivetrain solutions and engineering of the chassis, steering, brakes and ancillary electrics.

Assessing the need

Astheimer explains that the need for such vehicles is being driven by developments in demographics, e-commerce and concerns for the health of urban environments. He points out that urban populations and e-commerce continue to grow, with the World Economic Forum predicting that around 36% more vehicles will be making deliveries by 2030. “The increase in demand for urban logistics is putting pressure on logistics companies, with last-mile deliveries now accounting for up to 50% of supply chain costs with many delivery companies losing money,” he says.

He also notes that light commercial vehicles are the largest single contributor of CO2 emissions within the logistics industry, pumping out 40% of the total emissions, and that urban clean air zones and corporate CO2 targets are forcing logistics companies to electrify their fleets. Furthermore, they require what Astheimer calls an “ecosystem of vehicles” to satisfy the variety of duty cycles and goods to be delivered in urban areas, including trucks, vans, cargo bikes and power-assisted carts and trolleys to aid pedestrian deliveries.

“Logistics companies have told us that the solutions that are available for urban last-mile logistics are not always fit for purpose,” Astheimer says. “The vans are not suited to the inner-city environment, being hard to park and with a load bay that is difficult to organise. Cargo bikes have reliability issues, are limited in load capacity and are exposed to the environment. What they need is the efficiency and manoeuvrability of a cargo bike but with the protection and load carrying capacity of a van.”

With that in mind, ELM set about assessing the market and the size of the potential opportunity. This began with a feasibility study in which an initial concept vehicle architecture and costing were developed and presented to potential customers for feedback, Astheimer recalls. “Here we determined that there was a big enough demand for a purpose-built urban last-mile delivery vehicle, if we could satisfy the needs of the logistics companies by reducing costs of operations, reducing vehicle downtime and helping with their transition to an electric fleet.”

Next came the creation of the proof-of-concept demonstrator. Based on the running gear of a Renault Twizy donor vehicle, it is a mobile representation of the idea built to show potential customers and investors what the design and engineering teams from Astheimer and Prodrive were capable of developing. They emphasise, however, that the production machine will have a bespoke powertrain and chassis. Just 12 months after the companies formed ELM Mobility as a joint venture, they revealed the proof-of-concept machine at CENEX in September 2024, receiving encouraging feedback from logistics companies.

Pursuing partnerships

“ELM is now moving into the phase of production readiness, which it will do by creating strategic partnerships in development, manufacturing and after sales support,” according to Astheimer. “The focus will be specifically on last-mile delivery, but we are well aware that the platform we are creating will have different applications and use cases, which we will look to explore once the delivery variant has been launched.”

Astheimer explains that they consulted several logistics companies to understand their load capacity needs to see whether they could be satisfied within the L7e constraints, determining that they could.

The European Union’s L7e category of ‘heavy quadricycles’ (EU Regulation 168/2013), specifically the L7e-CU cargo variant, limits the vehicle to an unladen mass of 600 kg without the main traction battery, a maximum width of 1.5 m and maximum length of

3.5 m. ELM set the maximum height at 2.1 m to respect parking constraints. The regulation also stipulates a maximum continuous power of 15 kW, a top speed of 90 kph and seating capacity for up to two people.

“To maximize cargo capacity within these constraints, the vehicle architecture focuses on minimising the cabin dimensions in x, y and z, whilst retaining driver comfort, safety and ingress/egress ergonomics,” Astheimer says. “The result is that ELM has designed a vehicle where the load volume is circa 60% of the total vehicle volume, delivering 15% more usable and configurable cargo space than a standard compact van, while the platform weighs 50% less and has a 40% smaller footprint.”

The headline specifications for the planned production machine are a vehicle weight of 850 kg (including the battery), 4 m3 of load volume and the ability to carry a standard 1.6 m Euro pallet. Such pallets have a base footprint of 1200 × 800 mm, a base height of 144 mm and a maximum height including cargo of 1.6 m.

“What we understood from the duty cycles of the last-mile logistics companies we spoke to, is that the delivery driver will max out at approximately 150 stops per day, and that the average size of a parcel is approximately the size of a shoebox, resulting in a total load volume of circa 4 m³.

Pallet priority

ELM asked fleet managers why they had vans of different height, receiving the answer that they needed the taller vans to fit those 1.6 m high Euro pallets, which is a requirement that a compact van cannot satisfy.

Astheimer emphasises that the ELM is the only sub-4.5 tonne light cargo vehicle capable of carrying such a pallet. He explains that accommodating this requires a spacious and tall cargo bay with side-loading capability and a flat floor just 30 cm from the ground. “This has been a key attribute requested by several last-mile logistics companies.”

The company has also designed a dedicated pallet loader that folds up into the load bay with the pallet, so that pallets weighing up to 300 kg can be loaded and unloaded without a forklift.

“When we went back to the logistics companies with this lightweight, compact high-capacity delivery vehicle concept, their response was that this would be a “game changer.”

Stability confirmed

The wheelbase and track dimensions were chosen to provide a safe balance between manoeuvrability and stability, resulting in the positioning of the wheels in the four corners of the footprint. ELM has a turning circle 4 m in diameter, making it manoeuvrable and easy to park in dense urban zones – critical features for meeting service times and overall operational efficiencies. Prodrive has confirmed the stability of the design through simulation, Astheimer says.

The driver sits behind the front wheels rather than above them to provide a position that is functionally safe but also feels that way. This had to be achieved in a cab that is limited in both length and height, while maximising the load volume within the tight vehicle footprint.

These constraints have been carefully balanced with the driver’s need for comfort, visibility and ease of ingress/egress. The combination of a narrow cab and a single central seat allows the driver to get in and out on either side.

The driver is in a more upright position than would be the case in a typical vehicle, with their hips when seated at approximately the same height as when standing next to the vehicle, meaning that the driver translates in and out horizontally. This also reduces the length of the cabin to allow for as long a load box as possible within the overall dimensions of the vehicle.

The windscreen wraps around the driver, giving a large field of view of approximately 225°. Combined with a low dash and glass doors, the driver has a direct field of view around the cabin of approximately 250°, while the large mirrors on either side and the rear view camera extend the view around the vehicle to full 360° vision. The elevated driving position also means that the driver’s eye height is similar to that of vulnerable road users such as pedestrians and cyclists, Astheimer notes.

Engineering solutions for the drivetrain, chassis, materials, manufacturing, batteries and charging are still in the early stages of development. ELM’s intellectual property is centred on the vehicle’s architecture, and the company will partner with other specialists for off-the-shelf or modified parts and subcontracted manufacturing.

Range and energy

However, they have chosen key high-level macro numbers around range and battery capacity, Prodrive’s Kevin O’Flynn notes. “We’re targeting a 50 to 100 mile range with a 10 to 20 kilowatt hour capacity target. The former is based around what potential customers are telling us, and the use cases in the urban environment, and then the latter is based around what we think is feasible given the vehicle packaging, mass and payload.”

He continues that the specification of the rest of the powertrain is guided by a number of aspects, particularly the required level of continuous power. “Peak power figures will be determined based around our maximum payload targets and peak performance use cases (acceleration, top speed, gradeability) but also marrying that up with what we can source from the supply chain considering our targeted bill of materials (BOM) cost.”

When it comes to details of the desired battery specification, including chemistry, packaging efficiency is the foremost consideration at this stage, O’Flynn emphasises. “That will then drive some of the form factor and chemistry options available to us based on what we can get from the market. And then, within that space, we also need to consider ancillaries like the power distribution units, contactors, connectors and thermal management as well. So, where the key challenge is for us is being able to fit all of that into the space.

“We’re not at the stage yet where we are talking specific chemistries because we’re going to be guided by the platforms we can get from the market that will enable us to meet our financial constraints first and foremost.”

Higher safety standard

While the inherent safety of the battery chemistry, controlled by the battery management system and the thermal management system, is a consideration for discussion with battery suppliers, crash safety is an issue about which ELM has made a key decision. “L7e doesn’t mandate any crash safety targets, whereas N1 does (N1 is an EU category covering electric vans, small trucks and light commercial vehicles under 3500 kg) , but we think it’s our duty to deliver a vehicle that drivers feel safe driving, and fleet buyers feel safe buying to put in drivers’ hands. So, we want to deliver a vehicle that meets the same level of passive safety as an N1 vehicle,” O’Flynn emphasises.

“Considering what that means for battery packaging and the body structure around the battery, that’s been the main thing up to now in terms of feeding into the product architecture.”

He adds, “Detailed safety concepts will be addressed in the detailed design phase with battery partners. Thermal management of the battery is considered crucial, with a preference for simpler systems to reduce complexity and potential issues.

Charged issue

Customer feedback indicates a preference for faster charging to minimise downtime, and the ability to use both public charging infrastructure and the chargers that logistics operators might have at their bases. The aim is to support existing AC and DC charging infrastructure, with a focus on achieving a useful amount of charge in a shorter time for AC charging and exploring options for rapid DC charging, Astheimer explains.

“From the customer’s point of view, charging is linked to range and downtime. If you can charge by a significant amount in a lunch break, for example, or between rounds as you’re loading the vehicle, that may enable us to have a slightly smaller battery. They would like to be able to use public charging infrastructure where possible so as not to have to get back to the depot to plug in. So, range and charging are interlinked.”

O’Flynn adds that AC and DC charging mean different things for the vehicle, bringing their own challenges. “Taking AC first, there’s a mix of what people have in their depot environments and even in the public domain. The interesting thing for us is that with the size of the battery we are talking about, we have an opportunity to add a useful amount of charge in a short time,” he says. “But at the same time, with the L7e vehicles, which typically have 48 V systems, there are still challenges with power management.”

Therefore, ELM is still examining all the available options and, as with the battery, figuring out how much space the on-board chargers will take up and how much thermal management they will need. Other factors in play include whether customers can upgrade their own infrastructure from, say, 7 kW up to 22 kW, or have a greenfield site ready to accept a bank of new 22 kW chargers.

There are also decisions to be made around DC charging, O’Flynn continues. “Again, we have some challenges with the vehicle BOM and the bus voltage constraints around DC charging, but we are exploring options to support rapid charging with some of our partners already,” he says. “Ideally, we are looking at 30 minutes or so to get from 20% to 80% charge to support that lunch break case.”

The constraints on dimensions and mass imposed by regulations around L7e-CU vehicles are very challenging, O’Flynn notes. “They give us some very strict targets to hit with the amount of hardware and battery capacity you want in the vehicle.”

Then, there is the BOM to consider, which affects the production cost and ultimate price of the vehicle. “ELMs business case is based around taking some market share from existing N1 compact vans, so we need to better the sales price of those products as well as the existing L7e market,” he says. .

Efficient choices

“What that means for us on the powertrain side of things is we have to be efficient with all of our design in terms of what partners we select, where we’re sourcing from and then, ultimately, in terms of actual design choices,” says O’Flynn.

“A lot of the L7es are 48 V vehicles because there is less regulation associated with hazardous voltages around things like connectors and creepage clearance for insulation, which would otherwise add layers to your BOM complexity and cost.”

However, the team is exploring how they might benefit from the commoditisation of EV hardware. “Many existing L7es have been around for a decade or so, and things have moved along a lot in that time. So, there is an opportunity to increase the performance of the vehicle by going beyond that 48 V threshold and using the commoditised aspect of what’s out there.”

Proving assumptions

The programme’s next engineering phase involves proving baseline concept assumptions, focusing on commercial viability, engineering BOM cost and capital expenditure. “A lot of people in the team have come from EV start-ups in the UK, and we’ve learned from what happened to some of those over the past few years about the level of investment required to deliver certain solutions. So, we need to balance that with fundraising to be able to bring the solution to reality,” O’Flynn says. “We need to prove out those concepts to make sure they are viable from a commercial perspective.”

As part of that effort, ELM aims to build 10 full-scale prototypes for engineering validation and customer trials, which will be used to secure further funding for industrialisation and factory ramp-up.

These prototypes will serve to validate various systems, including the battery, powertrain, climatic conditions and human factors, while also serving to educate potential customers and gather feedback on the vehicle’s suitability for their operations.

Strategic partnerships are crucial for manufacturing, with ongoing conversations focused on hardware development, off-the-shelf systems and production plans. Discussions include aligning developing technology with product needs, and ensuring the viability of sourcing components at the required volumes and cost.

Robust and repairable

The design prioritises durability for the drivetrain and repairability for exposed parts – the result of direct feedback from potential customers. One logistics company said that they don’t want any vehicles on the road that have any visible damage, meaning that they have to be quick and easy to repair. This has led to all the three-quarter panels being separate, with the intention of limiting damage to relatively small parts that are easily removed and replaced, explains Astheimer, and he adds “that all the lights are deeply recessed so that they will be very difficult to damage.” A package of spares covering all the components most likely to be damaged will be offered with the vehicles.

ELM also designed the door hinges to be very robust following customers telling them that the first thing they do after they buy a van is to reinforce the hinges because drivers are always throwing them open and slamming them shut.

“The drivetrain they regard essentially as a fit-and-forget item, so that will be engineered for durability first and foremost,” O’Flynn says.

“All those things are really important for the customer,” agrees Astheimer. “Downtime is their biggest killer. One customer said: ‘If you could guarantee me zero downtime, I’d pay double for the vehicle’.” ELM’s production target is 10,000 units per year, with various scenarios mapped out based on potential partnerships. The timeline for commercial operation is dependent on investment schedules, with a target start of production set for 2028.

Click here to read the latest issue of E-Mobility Engineering.

ONLINE PARTNERS